A Temporary Rate Buydown

In today's dynamic real estate landscape, gaining a competitive edge is crucial. Seller- and/or buyer-funded interest rate buydowns offer a strategic advantage that can benefit both parties involved in a home sale or purchase.

What is a Temporary Buydown Loan?

Temporary buydowns offer a unique opportunity for both sellers and borrowers in the realm of fixed-rate mortgages. This arrangement involves a discounted interest rate for the initial one to two years of your mortgage, followed by a return to the full note rate for the remainder of the loan term. To bridge the gap between your reduced payments as the borrower and the standard payments received by the lender, a predetermined sum is withdrawn from a dedicated escrow account, generously funded by the seller for this purpose. The result is that the total monthly payment received by the lender, comprising your (the borrower's) contribution and the escrowed amount, remains consistent, mirroring what it would be without the temporary buydown.

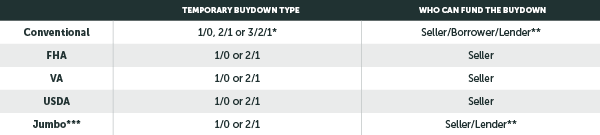

THE TABLE BELOW LISTS THE TEMP BUYDOWN OPTIONS BY LOAN TYPE

*A 3/2/1 temporary buydown is only available as a seller-paid buydown. **Lender-paid buydown is only available using premium pricing and may not be available for every scenario. ***Not available through all Jumbo investors.

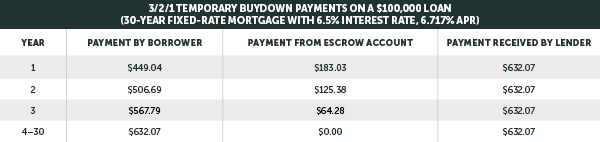

How does a 3-2-1 temporary buydown work?

A 3-2-1 temporary buydown offers a structured reduction below the note rate, with a three percent (3%) reduction during the first year, followed by a two percent (2%) reduction during the second year, and finally, a one percent (1%) reduction during the third year of the loan. After this initial period, the interest rate returns to the full note rate for the remaining loan term. Notably, these annual interest rate changes occur automatically, eliminating the need for the borrower to undergo a requalification process.

BELOW IS AN EXAMPLE OF THE BREAKDOWN OF A 3-2-1 TEMP BUYDOWN

For the example above, taxes and insurance are not included in the monthly payment.

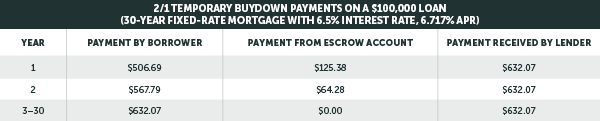

How does a 2-1 Temporary Buydown Work?

A 2-1 temporary buydown offers a structured reduction below the note rate, featuring a two percent (2%) reduction during the first year and a one percent (1%) reduction during the second year of the loan. After this initial period, the interest rate returns to the full note rate for the remaining loan term. Notably, the transition from year 1 to year 2 is seamless and automatic, eliminating the need for borrowers to undergo requalification for the loan.

BELOW IS AN EXAMPLE OF THE BREAKDOWN OF A 2-1 TEMP BUYDOWN

For the example above, taxes and insurance are not included in the monthly payment.

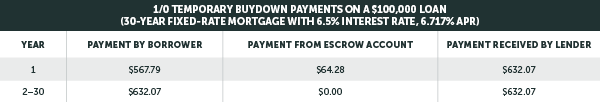

How does a 1-0 Temporary Buydown Work?

A 1/0 temporary buydown offers a structured reduction below the note rate, with a one percent (1%) reduction during the first year of the loan. After this initial period, the interest rate returns to the full note rate for the remaining loan term. Importantly, the transition after the first year is automatic, sparing borrowers from the need to undergo requalification for the loan.

BELOW IS A BREAKDOWN OF A 1-0 TEMP BUYDOWN

For the example above, taxes and insurance are not included in the monthly payment.

Advantages for the Seller

- Price Protection: Avoid the need for price reductions, ensuring you retain your home's value.

- Tax Benefits: The incurred cost may qualify as a tax write-off, potentially saving you money.

- Positive Perception: Offering concessions can enhance goodwill during the selling process, creating a positive experience for both parties.

- Broader Appeal: Make your home accessible and attractive to a wider pool of potential buyers, a valuable advantage, particularly in a high-interest rate market.

Advantages for the Buyer

- Upfront Cost Savings: Enjoy immediate cost savings when acquiring your new home.

- Monthly Payment Reduction: Secure a lower interest rate that can translate into more affordable monthly mortgage payments.

- Financial Flexibility: Gain the ability to allocate the extra cash towards various homeownership expenses.

- Principal Reduction: Any unused funds will be automatically applied to reduce your loan's principal balance, setting you on a path to greater homeownership equity.

*This advertisement does not constitute tax advice. Please consult a tax advisor regarding your specific situation.